China Yuchai: Deep Value Meets Growth (NYSE:CYD)

With undervalued assets, a newly enhanced strategic JV with Rolls-Royce, and exposure to booming data center demand, CYD is a deep value investor’s dream.

Summary

China Yuchai Limited (CYD) is one of China’s largest diesel engine manufacturers, boasting strong global partnerships, including a 50/50 joint venture (JV) with Rolls-Royce’s MTU division. The company is poised for an earnings inflection driven by surging data center demand for backup power generation solutions. Despite 20% p.a. earnings growth potential over the next five years, CYD trades at an astonishingly low valuation of 2x EBITDA, 0.3x book, 30% free cash flow yield, and a net cash balance sheet that supports 90% of the company’s market cap. This stands in contrast to its peers, which have experienced substantial re-ratings. Enhanced corporate governance, coupled with a long-term activist investor on board, has led to significant buybacks, with the company repurchasing nearly 10% of its outstanding shares in recent months to take advantage of the valuation discount.

Historical Context and Market Trends

CYD’s core asset is a 76% stake in Guangxi Yuchai Machinery Co., one of China’s largest diesel engine manufacturers in China.

Historically, Guangxi Yuchai has focused on the heavy-duty truck (HDT) market, which has faced several challenges in recent years:

Economic Slowdown: Since mid-2021, the broader economic slowdown has elongated replacement cycles and dampened demand for new sales

Fuel Mix Shift: Domestic sales of diesel engines have declined from ~98% in 2016 to ~55% as LNG and new energy vehicle (NEV) engines gain traction.

Stringent Emission Standards: Increasing regulations have added pressure on the traditional diesel market.

Between 2013 and 2023, CYD’s on-road engine sales volumes dropped 65%. However, the company offset this decline by shifting its mix to higher-value, larger engines and increasing off-road engine sales. This resulted in stable revenues, with average sales prices doubling over the decade, albeit with some gross margin pressure, with gross margins declining from ~20% to ~16%. Positively, gross margins are inflecting.

Industry Outlook

The Chinese HDT market is entering its fifth year of correction after peaking in 2020. Historically, the industry follows five-year up/down cycles, suggesting a potential recovery is nearing. Government trade-in policies, which heavily influence industry demand, are increasingly supportive.

Cummins, in its recent Q424 results presentation, highlighted that it expects its overall 2025 China revenues to be “flat to up 5%”, driven by negative 5% to positive 10% growth in the heavy and medium-duty truck demand and “strength in other markets, particularly power generation, where demand is expected to remain high as data center momentum continues.”

Growth Opportunities in the Off-Road Segment

CYD has successfully diversified into off-road applications, with volumes increasing from 121,000 units in 2013 to over 170,000 units in 2023. The most promising growth avenue lies in the power generation market for data centers. Large data centers require substantial backup power, typically supplied by diesel generators.

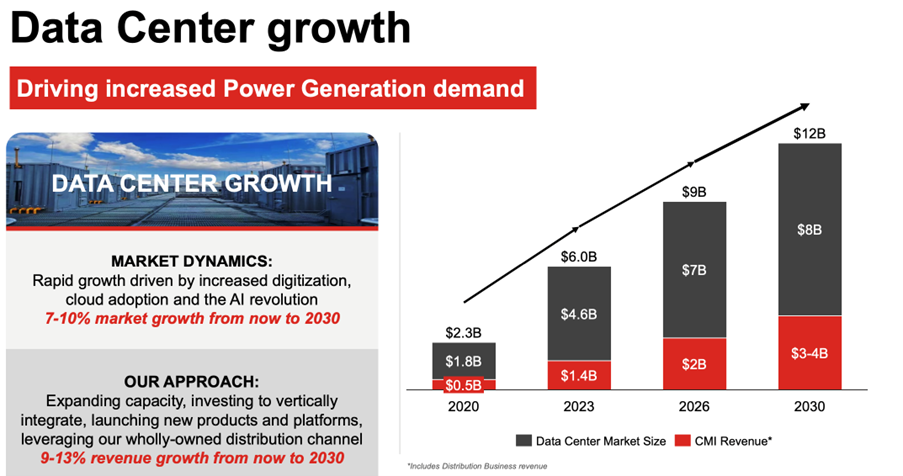

Total Addressable Market (TAM)

Diesel engines (~60% of total genset value) are combined with alternators and control systems to produce generator sets (gensets). Genset demand correlates with data center capacity expansion. JLL estimates 10GW of new projects to break ground in 2025 vs. 7GW completions (1). Channel checks suggest every 2MW of capacity requires around 8 gensets, translating to a TAM of ~40,000 units globally for the existing pipeline. However, with current annual production of only ~10,000 units globally and a ~US$300,000 ASP per genset, the market size is ~$3 billion.

Cummins estimates the data center TAM at $6 billion in 2023, growing to $12 billion by 2030 (2). This discrepancy versus my bottom-up estimate arises from Cummins’ integrated business model, which includes installation and long-term service contracts as part of its group revenues. Currently, CYD mainly manufactures diesel engines, relying on third parties to produce gensets.

Supply Constraints and Market Dynamics

The current global annual production capacity for large gensets is ~10,000 units, dominated by Cummins, Rolls-Royce MTU, and Caterpillar, which hold ~70% market share. Chinese players Yuchai and Weichai have a current combined capacity of ~1,000 units, with plans to double capacity in 2025. While Chinese production primarily serves domestic demand, long-term opportunities exist for global expansion through JVs like Yuchai/MTU.

Due to the demand-supply imbalance, a significant multi-year backlog exists globally, with Caterpillar highlighting “it’s really all about how quickly you can increase capacity for your reciprocating engines” on its recent Q424 results call.

As a result, domestic substitution opportunities are rising due to extended lead times from international players. Recent price hikes and strong demand have resulted in ~50% incremental EBITDA margins for leading global manufacturers when analyzing their recent quarterly results, with channel checks suggesting price increases across the Chinese domestic supply chain too.

In China, regulations mandate diesel backup for data centers, creating domestic demand for ~3,000 gensets in 2024, which is expected to grow by at least 50% in 2025, with strong incremental growth expected to be driven by increasing demand from tier-1 players including Bytedance, Kuaishou, Tencent, Alibaba, etc.

Manufacturing data center-grade gensets requires significant technical expertise, including the production of critical components like crankshafts and cylinder blocks. Testing and validation, including thousands of hours of continuous operational uptime, further complicate market entry for new players, especially into tier-1 supply chains, where reliability is arguably more important than cost.

The recent success in Chinese AI models including Deepseek could provide a catalyst and drive broader Chinese domestic AI data centre demand by tier-2 and 3 players according to Jevon’s paradox. This represents a further potential opportunity for domestic players including Yuchai, although this is not the base case expectation.

Earnings Sensitivity for CYD

CYD’s exposure to data center growth comes through two channels:

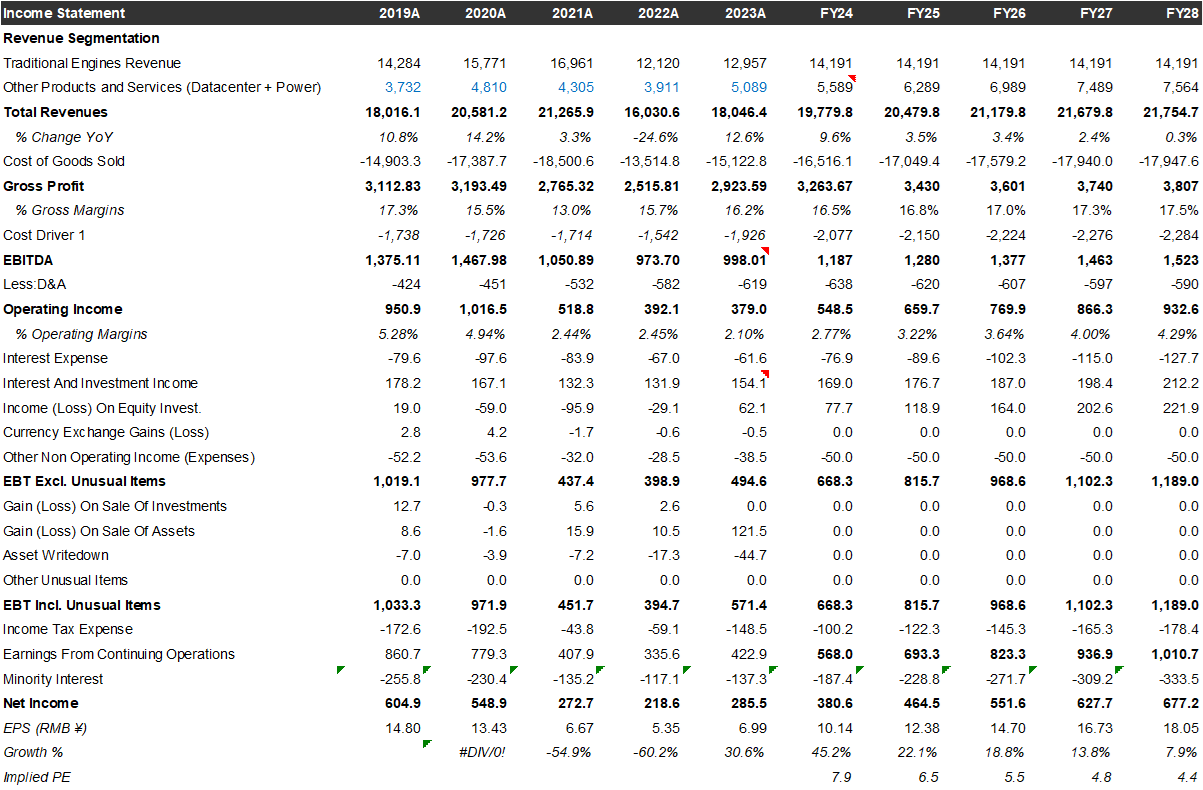

Revenue from Other Products and Services: This segment accounted for ~24% of revenues in 1H24, albeit only a small portion is directly related to data center applications through Yuchai’s YC16V and related product range, not only is the company expanding capacity through capex investment, Yuchai is also proactively marketing its product range at industry trade shows as shown in its recent Linkedin posts.

Conservative assumptions (¥1.2m RMB/engine, 30% incremental operating margins, 15% tax rate) suggest every 100 incremental engines manufactured by CYD could add up to ~¥23m in net income for CYD equity holders, with a pathway to 1000 engine sales by 2027, this could represent ¥230m net income.

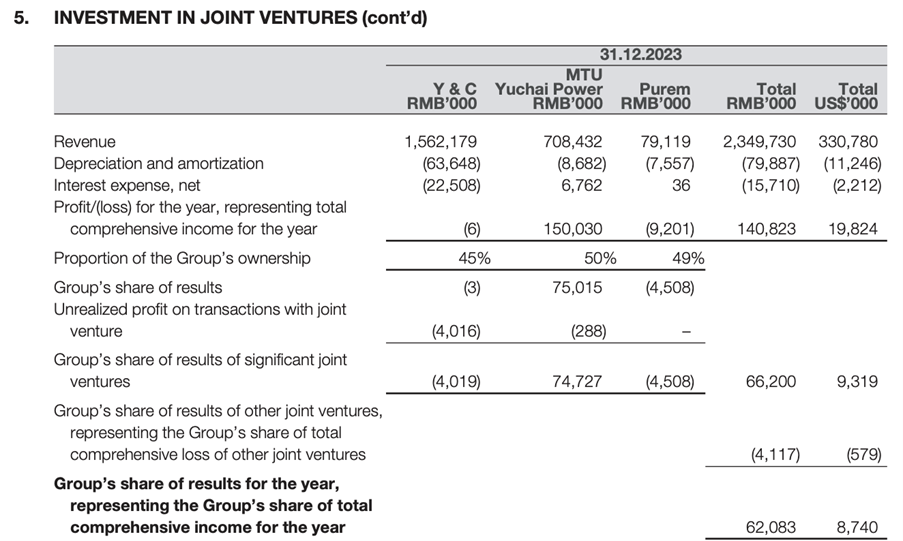

JV with MTU: The JV produces the Series 4000 large engines for power solutions including data center applications. In 2023, CYD sold over 500 Series 4000 engines, with a portion serving data center applications. With earnings up 86% yoy to ¥75m, this segment alone contributed ~25% of CYD’s ¥286m net income in 2023. The partnership expanded to include Series 2000 engines in August 2024 (3). There is an opportunity for this division to triple earnings attributable to CYD to over ¥200m by FY27.

The earnings bridge below provides an indicative overview of how CYD could compound earnings at ~20% per annum over the next few years even assuming no earnings growth contribution from its core HDT market, this is despite the HDT market likely currently at the bottom of the cycle.

Financials and Valuation

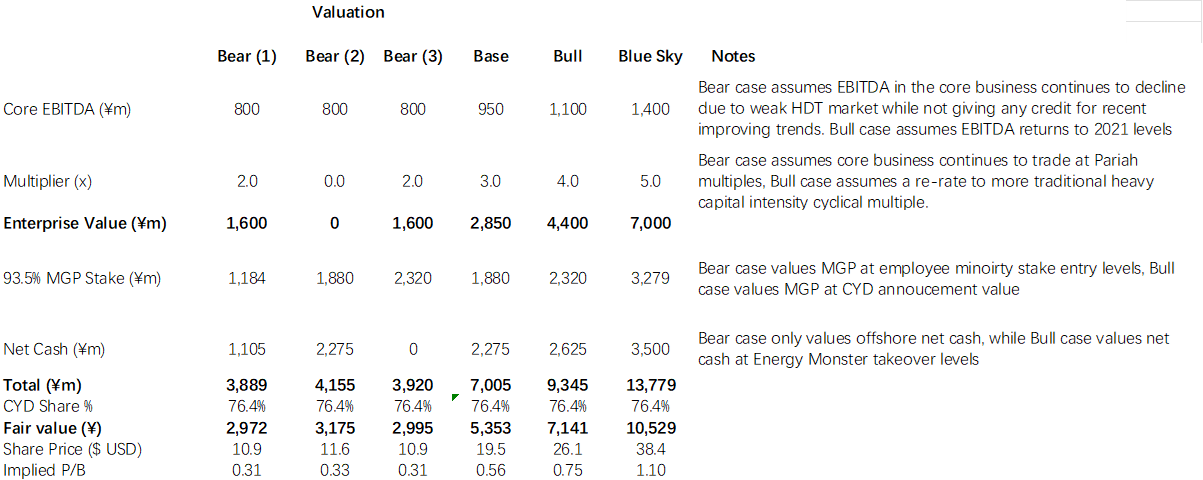

CYD trades at 2x forward EBITDA, 7x forward P/E, and 0.3x book value. With a potential 20% annual earnings growth over the next few years, the risk/reward skew appears highly favorable.

The cash on CYD’s balance sheet (¥3.5bn RMB) adds optionality, particularly given precedent transactions like Energy Monster’s (NASDAQ:EM) recent take-private deal at 0.8x net cash value, highlighting the significant value in onshore cash to the right owner.

In June 2024, CYD announced an employee share incentive scheme, where business leaders were invited to purchase shares in the “Marine and Genset” division (MGP) that holds 50% of the MTU JV stake, with MGP being valued at ¥2.48bn by CYD (4). Insiders eventually acquired a 6.5% minority stake for ¥83m, implying a ¥1.3bn value for MGP, factoring in minority and illiquidity discounts. As the valuation was completed before Rolls-Royce’s August announcement of expanding the partnership to also include the production of Series 2000 engines, the value of MGP has likely only increased further since the share incentive scheme. In the long term, there may be an opportunity for MGP to IPO and further crystalize the value of this business segment.

As the scenarios below show, to justify the current share price, investors are either placing significant discounts across all segments (Bear scenario 1), valuing the core business at 0 (Bear scenario 2), or valuing net cash at 0 (Bear scenario 3), these appear very conservative relative to how its peers are being priced.

Peer Comparison

CYD’s closest domestic peer, Weichai Heavy Machinery (SHE:000880), has recently seen a significant share price increase, reflecting the market’s recent recognition of its future earnings potential. Global peers including Caterpillar and Cummins have also seen strong performance driven by their respective power solutions business segments and typically trade at more than 10x EBITDA.

Offshore, The Weichai group also owns a controlling stake in Power Solutions International (NASDAQ: PSIX), which has seen its share price increase, with the stock now trading around ~12x FY25 EBITDA.

CYD’s largest shareholder, Singapore-listed Hong Leong Asia (SGX:H22) generated ~2/3 of its operating income from CYD in 1H24, and has seen a significant re-rate in its share price relative to CYD beginning August 2024.

Shareholder Activism

Hong Leong Asia holds ~45% of shares in CYD and controls board appointments, which may deter some investors. However, Shah Capital, the third-largest shareholder with a 10% stake, has actively engaged with management since 2008(5) and as recently as June 2024, called the management team “extremely indifferent to his requests” in unlocking value for shareholders(6). However, Shah’s recent shift from a 13D (7) to a 13G (8) in the August 2024 filing suggests confidence in recent corporate governance changes, including the $40m share buyback completed in October 2024.

Sources:

(1) https://www.us.jll.com/en/trends-and-insights/research/data-center-outlook

(2) Cummins 2024 Investor Day Transcript

(5) https://www.bizjournals.com/triangle/stories/2009/06/01/story4.html

(6) https://www.shahcapital.com/shah-outperforms-market/

(7) https://investor.cyilimited.com/static-files/be52cb3c-9ec2-45f6-ad21-9217507feedb

(8) https://investor.cyilimited.com/static-files/d5bc546a-7145-4918-9098-1f3f7d21e1f9

I linked to your post in my Monday emerging market links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-17-2025 Seeking Alpha has had pieces about the stock before...