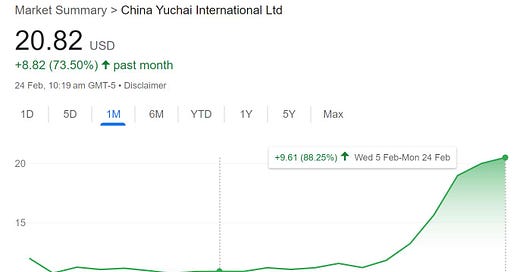

We’ve cashed out our entire position in CYD at ~$21.00 (vs. our ~$11.00 entry) ahead of tomorrow’s results, locking in a solid gain. Why? The stock soared past our base case target of $19.50—set in our first Substack note [Link]—in less than a month.

While that’s shy of our bull case ($26.10), the speed and risk profile screamed 'non-fundamental tailwinds.' We’ll take the win, thank the market gods, and move on: we focus on maximizing risk/reward, and when the facts change, we change.

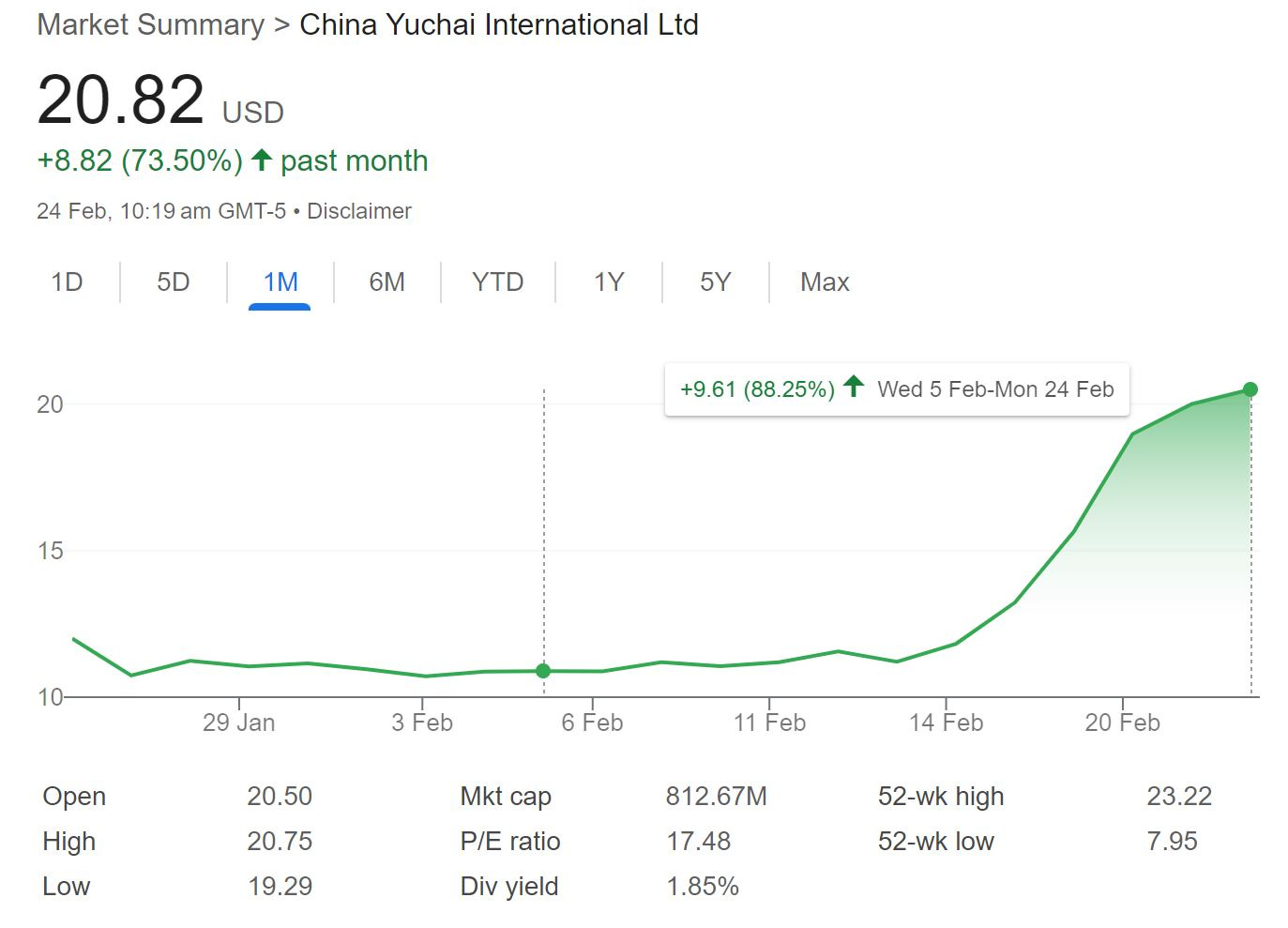

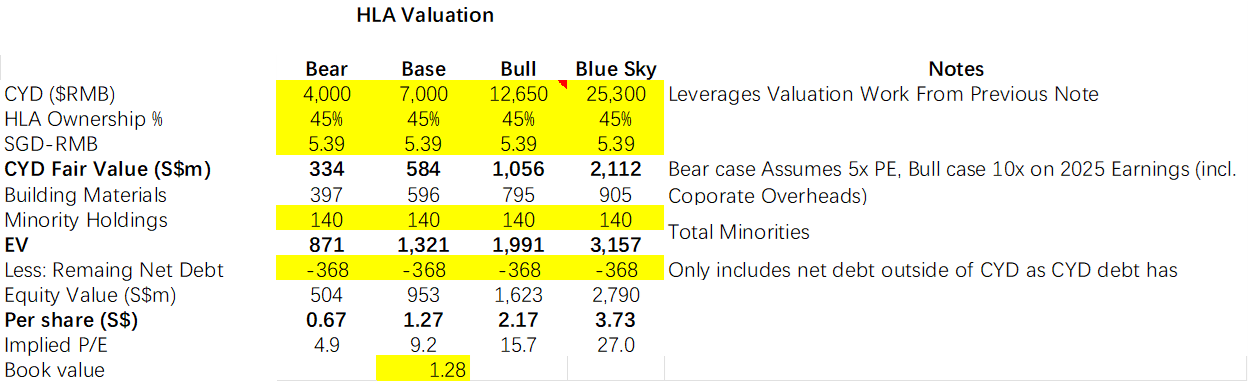

Where to next? We’ve rotated into H22.SI, profiled here [Link], and another AI data center play we’re keeping under wraps for now as we build our conviction. Here’s the thinking: H22, CYD’s parent company, offers a backdoor into CYD’s value at a steep discount. With ~50% of H22’s worth tied to its 45% stake in CYD, it’s lagged behind CYD’s recent run. H22’s net asset value (NAV) suggests it should trade near $1.30—30% above today’s price. In other words, buying H22 now is like time-traveling back to snag CYD at $15.00, assuming the market catches up.

CYD kicked off this Substack as our highest-conviction pick, and we’re proud of how it played out. Stick around—we’ll keep digging up intriguing companies to share.

Thank you for sharing this idea. If I interpret the earnings correctly, the JV is doing better than even your blue sky scenario. Could you share your thoughts on the last earnings? And did they just say that the orderbook for 2025 is already full?