Thakral Corporation: A Conglomerate Reimagined

Riding the Silver Tsunami and the Drone Revolution at 6x Earnings and an active buyback program

Summary: Since profiling Hong Leong Asia in February (link), the stock has risen by ~70%, significantly outperforming the Singapore Strait Times index, which has increased by around 10%. This has been driven by: 1) The Market realizing the underlying quality of Hong Leong’s assets, 2) improved corporate governance, and 3) Increased broker coverage.

We believe we have identified another setup in Singapore, offering diversified exposure to the world’s most highly sought-after Real Estate, coupled with exposure to the world’s most powerful drone company. This business has many parallels with Hong Leong, as Hong Leong’s subsidiary, China Yuchai Limited CYD 0.00%↑ which we previously also profiled, was the largest external shareholder until 2019.

Furthermore, the ability to acquire such a defensively diversified portfolio of assets at ~6x normalized earnings and more than 50% discount to our intrinsic NAV assessment represents a highly compelling risk-reward.

The new board also appears to agree with our evaluation, not only beginning to buy back shares at prevailing market prices, but also actively communicating its intentions to the market.

1.1 The Thakral Story: A Century of Adaptation

Thakral Corporation’s ($AWI.SI) history is a compelling narrative of entrepreneurial adaptation and strategic evolution spanning over a century. The Group's origins trace back to 1905 when Sohan Singh Thakral, after years of peddling textiles in Bangkok, established a retail shop named Punjab Store. An early indication of the family's forward-thinking business acumen emerged in 1936 with the opening of a branch in Japan, a strategic move that provided direct access to textile suppliers and improved margins.

The modern iteration of the Group began to take shape in 1952 when a 19-year-old Kartar Singh Thakral was tasked with establishing a Singapore branch, Thakral Brothers. Under his leadership, the business underwent its first major transformation. Recognizing the immense potential in emerging technologies, Kartar Thakral pivoted the company into electronics distribution in 1975. By leveraging its long-standing presence in Japan, the company secured crucial distribution rights for major Japanese consumer electronics brands, positioning it perfectly to capitalize on the global electronics boom of the 1970s and 1980s.

This venture grew so substantial that Thakral Corporation was established as a separate entity in 1982 and was subsequently listed on the Mainboard of the Singapore Exchange in December 1995. The company further demonstrated its strategic agility by successfully penetrating the Chinese market with these electronics brands as soon as the country reversed its communist policies, leveraging a textile business presence it had maintained there since the 1960s.

1.2 The Strategic Pivot to Asset-Backed and Lifestyle Ventures

As the consumer electronics market matured and became saturated, the Group executed its next major strategic pivot, shifting from a trading-focused business model to one centered on long-term, asset-backed investments. This transition reflects a deliberate decision to build a more resilient and predictable earnings base, moving away from the inherent cyclicality and lower margins of pure distribution.

The initial foray into real estate involved the creation of an Australian publicly listed entity, Thakral Holdings Group, which grew to become one of the largest foreign owners of hotels in Australia, including Melbourne's Hilton on the Park, The Menzies in Sydney, Sofitel hotels in Queensland's Brisbane Central and Gold Coast as well as Novotel Hotels on the eastern seaboard. In 2012, Brookfield Asset Management eventually acquired its Australian assets at a 50% premium to market price, but a 20% discount to NTA as the market became clouded over the Eurozone crisis.

The contemporary investment strategy of Thakral Corporation crystallized in October 2010 with the Group's first direct real estate investment in a property project in Melbourne, Australia. This was followed by the establishment of TCAP Pte Ltd in 2011 to formalize the origination and management of real estate projects. The company expanded into Japan's property market in 2013 with the acquisition of commercial buildings in Osaka.

However, the most transformative move was the 2015 joint venture with the Puljich family, seasoned operators of over-50s lifestyle resorts in Australia. This venture, officially branded as GemLife in 2016, marked Thakral's entry into the highly attractive land-lease community sector, an asset class characterized by strong demographic tailwinds and stable, recurring revenue streams. The Group's journey is aptly summarized by its CEO, who noted, "We've re-invented ourselves from VCRs to Drones", a statement that encapsulates a century-long history of successful adaptation and forward-looking strategy.

2.0 Analysis of Core Business Segments: Dual Engines of Growth

Thakral operates through two primary segments—Investments and Lifestyle—which function as dual engines driving the Group's growth. The Investment division provides a stable, asset-backed foundation with long-term recurring income. In contrast, the Lifestyle division targets high-growth consumer trends with a more capital-light, high-turnover business model.

2.1 GemLife: The Crown Jewel (~50% of NAV)

GemLife, Thakral's Australian property investment, has evolved into the Group's most valuable asset, representing ~50% of group NAV and a leader in the premium over-50s lifestyle resort sector.

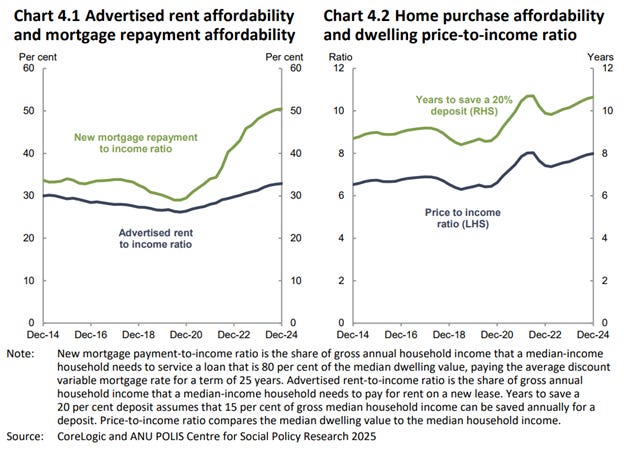

Why anyone would want exposure to Australian property assets would be a reasonable question for any value investor to ask, considering Australia is well documented as having one of the world’s most expensive property markets by any value measure.

We believe this is justified by the fact that, despite expensive property prices, Australian cities generally rank extremely high by any global livability index measure, as shown below.

Furthermore, Australia distinguishes itself from other Scandinavian countries that rank equally high on such surveys by being a migrant friendly country, with approximately 30% of the Australian population born overseas.

Do you aspire to have a better quality of life by moving to Zurich? It's better to start learning Swiss German early; knowing only High German may not be enough.

Despite the valuation, for Chinese buyers, who have historically been the largest foreign buyers of Australian property in recent years, this is a simple value trade given that Chinese property is even more expensive on a price-to-income basis.

Chinese buyers aside, it is also an open secret that other wealthy investors are also buying property across Australia and New Zealand like candy, with German-born Peter Thiel allegedly building Doomsday bunkers in New Zealand.

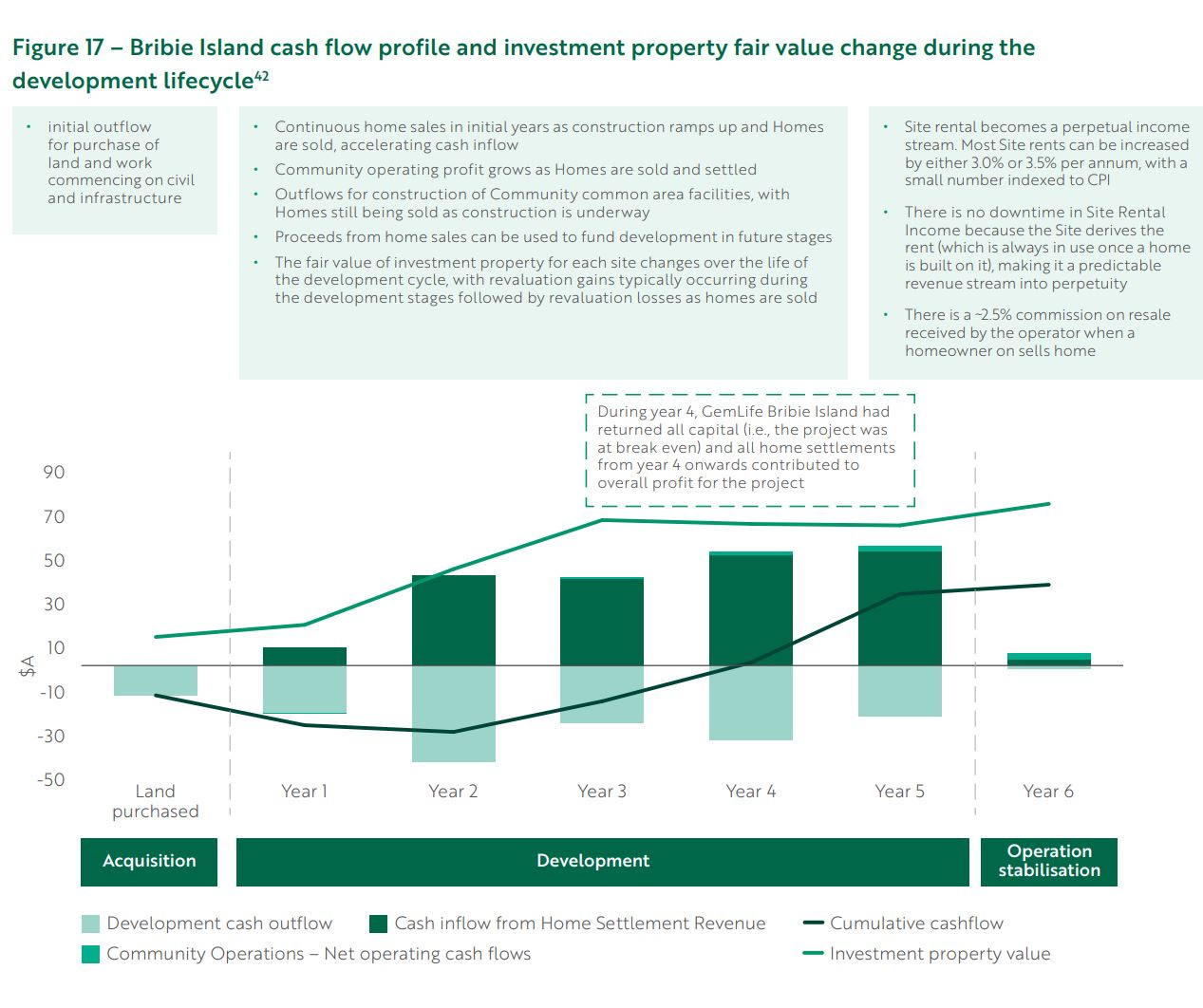

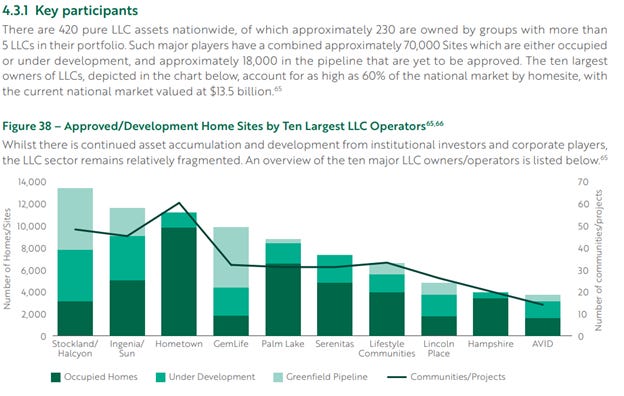

Business Model: GemLife operates under the Land Lease Community (LLC) model, the details of which can be found in the company’s prospectus (link). It is a financially compelling structure that benefits from two distinct and complementary income streams. First, the company generates upfront development profits from the sale of high-quality, prefabricated homes to residents. Second, and more critically for long-term value, it collects recurring, inflation-adjusted weekly site fees from homeowners who lease the land on which their homes are situated. This creates a growing annuity-like income stream that provides excellent revenue visibility and stability.

Scale and Growth Pipeline: Since its inception as a joint venture in 2015, GemLife has experienced rapid growth. As of March 2025, it had 1,862 occupied homes across its resorts, generating an estimated A$19.4 million in annual recurring site fees. The growth trajectory is well−defined, with a total development pipeline of approximately 6,500 homes, providing a clear roadmap for expansion through to 2033.

IPO and Value Crystallization: In a landmark event for Thakral, GemLife completed its IPO on the Australian Securities Exchange (ASX: GLF) on July 3, 2025. The offering raised A$750 million at a market, providing a transparent and public valuation for the asset. Following the IPO, Thakral's stake was diluted from 31.7% to a still substantial 16.8%, a holding that remains a cornerstone of its investment portfolio.

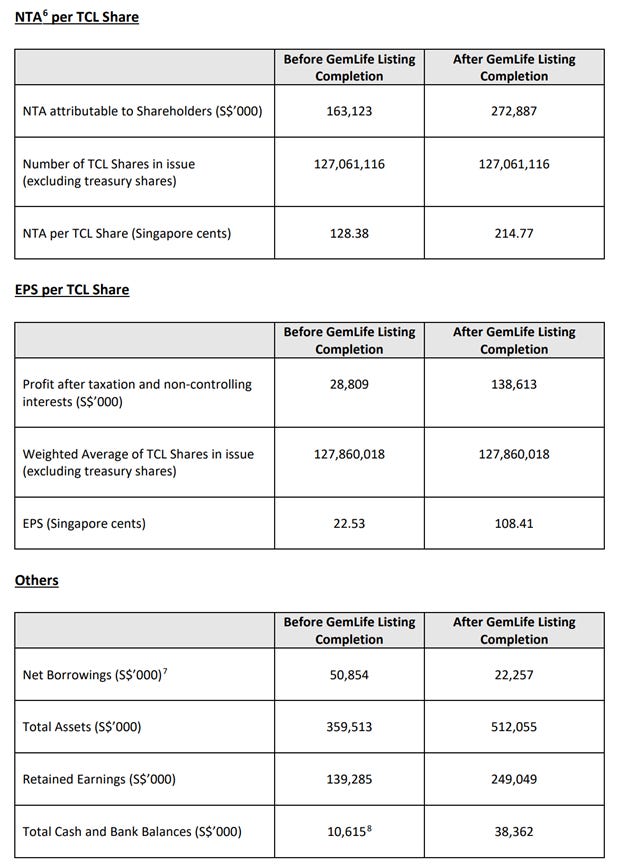

As Gemlife uses a stapled-security trust structure – a structure only familiar to Australian investors and designed to minimize tax leakage - Thakral provided an update to the market on the financial implications, which result in a near doubling of its statutory NTA, as shown below.

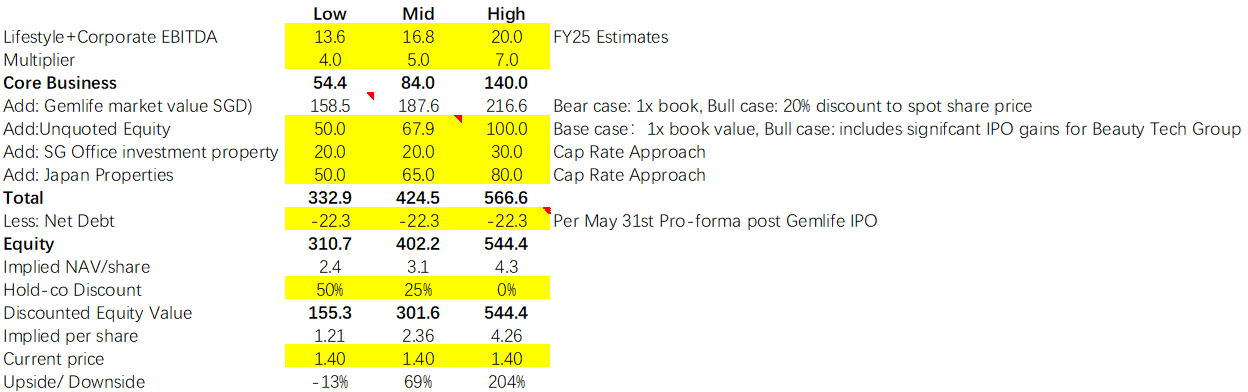

However, as we highlight in the valuation section later, even this NTA likely significantly undervalues the company, with our fair NAV assessment at over S$3.00.

Furthermore, as Gemlife had previously operated with extremely high leverage as a private entity, Thakral extended S$28.4 million of debt to Gemlife in 2024. With the repayment of such debt at Gemlife’s IPO, this also frees up significant capital at the corporate level. The company has begun actively repurchasing shares on the market after halting its activity at the end of 2024.

2.1.2 Core Property Portfolio: Stable Anchors in Japan and Singapore (~20% of NAV)

Complementing the high-growth GemLife venture is a portfolio of stable, income-generating commercial properties in Japan and Singapore.

Japan: Thakral has a long and distinguished history in Japan, dating back to 1935. Today, its Japanese portfolio consists of six landmark commercial office buildings and one hotel in Osaka, the country's second-largest city and one of the world's 7th most livable cities, as shown in our diagram above.

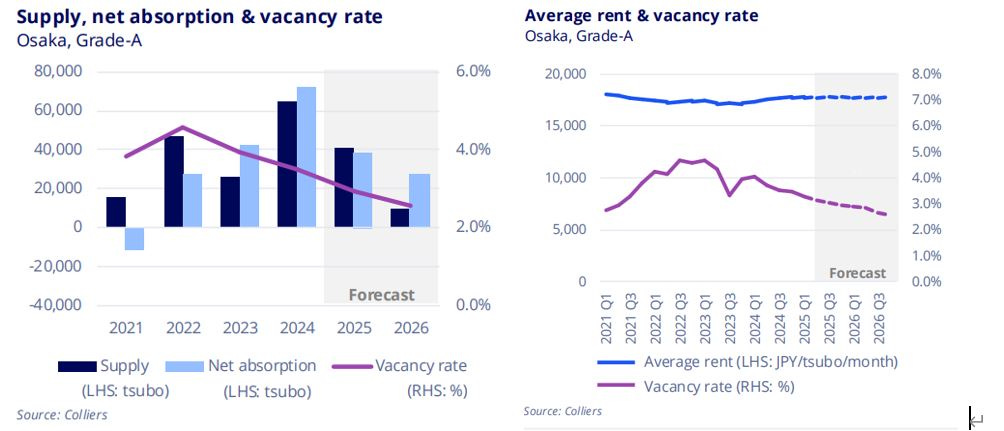

These assets serve as a cornerstone of stability for the Investment division, generating strong and consistent rental income, underpinned by a high average occupancy rate of 96%. The Group actively manages this portfolio, opportunistically recycling capital through strategic divestments, such as the profitable sales of the Riverpoint Kitahama Building and Hotel WBF Namba Motomachi. Overall, the demand/supply dynamics look quite positive for Osaka over the foreseeable future

Singapore: The Group owns an office property at The Riverwalk, located in a prime area along the Singapore River. This asset provides another steady stream of recurring rental income, contributing to the overall resilience of the Investment division's cash flows.

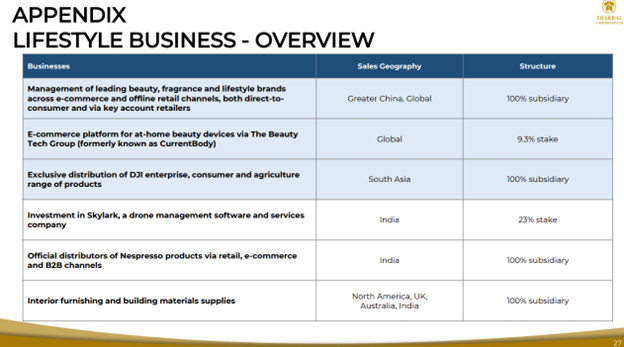

2.2 The Lifestyle Division: Tapping into High-Growth Consumer Trends (~20% of NAV)

Thakral’s transformation from a loss-making China-centric electronics distributor to a consistently profitable and geographically diversified value-added partner of choice over a decade timeframe is simply remarkable in our view.

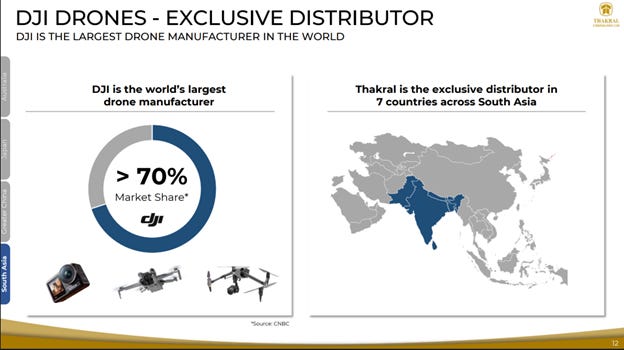

In a testament to its capabilities, DJI, the world’s largest drone manufacturer with 70% market share, chose Thakral as its exclusive distributor in 7 countries across South Asia.

The business has historically lost around S$10 million per annum since 2012, during its transformative years. However, since 2022, the company has been consistently profitable (even factoring in all corporate overheads) and generated an operating profit of S$10.2m in 2024, representing a 90% year-over-year increase, according to our calculations.

2.2.1 The Drone Revolution: An Ecosystem Strategy (~50% of Lifestyle Division’s Revenue and even higher profit contribution)

Thakral’s entry into the drone market is a masterclass in strategic execution, replicating the successful playbook from its electronics distribution era. The company identified the drone sector as a key long-term growth area and moved decisively to establish a dominant position in South Asia, highlighting in its 2015 annual report: “The Lifestyle Division has also transformed its portfolio with new products such as drones and a stabilized digital action camera manufactured by DJI, the world leader in drones”.

For those unfamiliar with DJI, this US select committee hearing provides an American perspective into the business (link).

Core Partnership: The cornerstone of the strategy is the exclusive distribution partnership with DJI, the undisputed global leader in drone technology, with over 70% market share.

Thakral holds the rights for DJI's full range of consumer, enterprise, and agricultural drones across seven South Asian countries, with India being the key focus market.

Building the Ecosystem: Thakrel’s strategy extends beyond mere distribution to create a defensible, integrated ecosystem.

Upstream Integration (Components): To capture a larger share of the value chain, the Group established Bharat Skytech, a B2B subsidiary that specializes in critical drone components and batteries. This unit supplies local drone manufacturers in India, positioning Thakral as a pivotal player in the development of the domestic drone industry. Bharat Skytech has already commenced generating revenue, marking a key operational milestone.

Downstream Integration (Software & Services): Recognizing that hardware is only part of the solution, Thakral has invested in Skylark Drones, an India-based leader in enterprise drone software and services. In 2024, Thakral increased its stake in Skylark to 23%, solidifying its access to the high-margin software layer of the drone economy.

This comprehensive approach—partnering with the global hardware leader while simultaneously investing in the local component and software ecosystem—provides Thakral with multiple avenues for growth and a significant competitive advantage. The strategic acquisition of an existing Indian company in late 2023 provided the on-the-ground infrastructure and a team of approximately 130 employees, allowing the Group to bypass years of organic setup and scale the DJI business rapidly.

2.2.2 Beauty, Fragrance & Nespresso

The Group manages and distributes a portfolio of leading beauty and fragrance brands, including Maison Margiela, Ralph Lauren, and Miu Miu, primarily in the lucrative Greater China market. This is complemented by strategic investments designed to capture upside from adjacent high-growth areas.

A key example is its equity stake in The Beauty Tech Group (formerly CurrentBody.com), a global leader in at-home beauty devices. This investment has already yielded unrealized valuation gains, and The Beauty Tech Group is exploring a potential IPO on the London Stock Exchange, which could serve as another significant value-unlocking event for Thakral. Currently, Beauty Tech Group is held on Thakral’s books at ~S$17m; this stake alone could be worth over S$50m at the rumored IPO price of £350m.

Further demonstrating its ability to secure partnerships with premier global brands, Thakral obtained the official distribution rights for Nespresso in India. It launched a dedicated e-commerce platform in December 2024, followed by the opening of the first Nespresso boutique in a premier New Delhi mall in March 2025, positioning it to capture the rapid growth in India's premium coffee market.

3. Governance and Capital Allocation: Prudent Stewardship for a New Era

Thakral's corporate governance framework has undergone a significant and positive evolution, striking a balance between the long-term vision of its founding family and robust independent oversight. The Board of Directors is structured with a majority of non-executive directors, and independent directors constitute half of the board, ensuring no single individual or group can dominate decision-making.

A pivotal moment in this evolution occurred at the April 2025 Annual General Meeting with the retirement of the Group's 91-year-old founder, Mr. Kartar Singh Thakral. This generational transition was accompanied by the landmark appointment of Mr. Lim Swe Guan as the new Independent Non-Executive Chairman. Mr. Lim's distinguished career includes senior roles at the Government of Singapore Investment Corporation (GIC), where he was the Global Head of the Corporate Investments Group for real estate.

His appointment brings an exceptional level of institutional credibility, deep real estate expertise, and a rigorous governance mindset to the board's leadership. This is not merely a procedural change but a powerful, deliberate signal to the market of the company's commitment to professionalizing its governance to attract institutional capital.

While the Thakral family remains deeply involved, ensuring continuity and a strong alignment of interests with shareholders, a blend of seasoned family leadership and enhanced independent oversight creates a robust governance structure.

Already, we are beginning to see early signs of change, with the company taking a much more proactive approach to investor relations activities, which culminated in its first analyst research published in June 2025 (link).

This mirrors the approach that we have seen at Hong Leong Asia and China Yuchai. In fact, CYD (and by extension H22) was the largest shareholder in Thakral up until 2018, highlighting the close intertwined fortunes of two of Singapore's wealthiest dynasties.

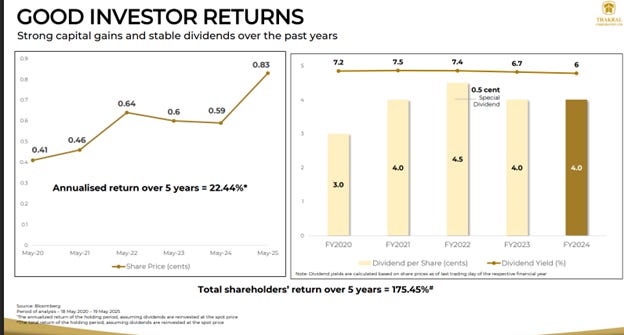

Thakral’s management has demonstrated a disciplined and shareholder-focused approach to capital allocation, utilizing a dual strategy of consistent dividend payments and opportunistic share buybacks to deliver industry-leading returns to shareholders.

The company has a long and consistent history of returning capital to shareholders through biannual dividends. This commitment is formalized in a dividend policy, effective from FY2025, which targets a payout that is the higher of a base payment of 4.0 Singapore cents per share or approximately 20% of the net profit attributable to shareholders. With the IPO of Gemlife and the potential listing of Beauty Tech Group, we believe substantial opportunities also exist for special dividends beyond what’s already publicly announced.

In addition, the Board maintains an active and regularly renewed Share Buyback Mandate, with the authority to repurchase 10% of its shares outstanding at present. Most recently, the board purchased shares in July 2025 at a price of up to S$1.40, while the board has stopped repurchasing shares as of the 11th, we believe this is to satisfy listing rules as the company is prohibitied purchasing shares one month immediately preceding the announcement of its half-year and full-year financial results (slated for the close of trading on Wednesday August 13th).

4.0 The GemLife IPO: A Transformative Financial Catalyst

The IPO of GemLife on the Australian Securities Exchange was more than a liquidity event; it was a transformative catalyst that fundamentally reset the financial position and valuation proposition of Thakral Corporation.

For years, the substantial value of GemLife was embedded within Thakral's balance sheet as an investment in an unlisted associate, making it difficult for the market to accurately assess. The IPO crystallized this value by assigning it a transparent, public market capitalization of A$1.58 billion. This event effectively removed the valuation ambiguity and forced a re-evaluation of Thakral's intrinsic worth. Demonstrating its long-term belief in the venture, Thakral subscribed for additional shares during the IPO, cementing a final holding of 16.8%. This entire stake is subject to escrow arrangements until at least mid-2026, ensuring a strong alignment of interests with new GemLife shareholders.

The IPO also triggers a crucial change in accounting treatment. With its stake falling below 20%, Thakral will no longer use the equity method to account for GemLife. Instead, it will be treated as an "investment at fair value through profit or loss". This means that going forward, Thakral's income statement will no longer include a share of GemLife's profits. Instead, it will reflect two new items: dividends received from GemLife and periodic, non-cash fair value adjustments based on the movement of GemLife's share price on the ASX. This will make Thakral's reported earnings more volatile but also more directly reflective of the public market's valuation of its key asset.

5.0 Sum-of-the-Parts (SOTP) Valuation

To determine the intrinsic value of Thakral's diversified portfolio, the Sum-of-the-Parts (SOTP) valuation methodology is the most suitable approach.

6.0 Key Risks: The most significant risk to our thesis lies in Gemlife, given that it accounts for nearly 50% of the group’s valuation

Regulatory Scrutiny and Peer Contagion Risk: The Australian LLC sector has recently faced heightened scrutiny following a landmark ruling by the Victorian Civil and Administrative Tribunal (VCAT) against peer operator Lifestyle Communities (ASX: LIC). The tribunal declared LIC's Deferred Management Fee (DMF), or exit fee, clause void because it was calculated on the future sale price of a home, which was not a quantifiable amount at the time of contract signing as required by Victorian law. This ruling triggered a severe decline of over 38% in LIC's share price and created uncertainty about potential liabilities from refunding past fees, estimated to be as high as $250 million. It is critical to note that GemLife's business model is fundamentally different and is insulated from this specific risk, as it does not charge exit fees. However, the case has drawn negative media attention to the sector and may lead to broader regulatory changes, particularly in Victoria, which could impact all operators.

Property Price Dependency: The LLC model is intrinsically linked to the broader residential property market. GemLife's target customers are typically downsizers who fund their purchase by unlocking equity from their existing family homes. A significant or prolonged downturn in Australian house prices could reduce the amount of equity available to potential buyers, thereby slowing the rate of new home sales and impacting development profits.

Construction Cost Inflation: The Australian construction industry is experiencing significant cost pressures from material price inflation, supply chain disruptions, and skilled labor shortages. These factors can compress developer margins and cause project delays. GemLife is partially insulated from this risk through its vertical integration strategy, which includes in-house construction capabilities and its own concrete production facilities, giving it greater control over costs and timelines compared to peers reliant on third-party contractors. Nonetheless, sustained, industry-wide cost inflation remains a key risk to profitability.