The Labubu Trilemma

More Popular than Bitcoin and Nintendo: Exploring Pop Mart's ($9992.HK) Balancing Act Between Scarcity, Sales, and Stability

Author’s note: This piece departs from our usual approach as a note that focuses on general research insights into global consumer behaviour instead of a company-specific investment thesis.

The Enigma of Labubu: A Toy That Broke the Mold

In a world hungry for the next big thing, Labubu isn't just a toy; it's a cultural phenomenon. This "ugly-cute" creature, with its signature wide grin and nine sharp teeth, has exploded from a niche collectible into a global fashion statement, a coveted accessory dangling from designer handbags, and a potent symbol of cultural cachet. Its rise has been nothing short of meteoric, sparking frenzied demand, epic queues, and even reports of chaotic scenes and physical altercations at retail locations worldwide.

At the heart of this global sensation stands Pop Mart, the Beijing-based powerhouse that has masterfully scaled Labubu's appeal. Pop Mart has rapidly transformed the designer toy market, pushing these once-niche items into the mainstream. But this remarkable success has ushered in a profound strategic dilemma, one that can be best understood through the lens of an impossible trinity.

The company finds itself caught between three inherently conflicting objectives in its quest for sustained success with Labubu:

Maintaining Labubu's Veblen good status: Keeping it exclusive and highly desirable.

Satisfying escalating shareholder expectations for growth: Selling a lot of Labubus.

Ensuring social stability and retaining state support: Avoiding public disorder and regulatory backlash.

This isn't just a business challenge; it's a high-stakes tightrope walk. Let's unpack this trilemma, exploring the intricate dance between market demand, corporate strategy, consumer psychology, and the ever-watchful eye of the Chinese state.

The Labubu Code: Why Everyone Wants a Piece

Labubu's journey to global icon status is a fascinating blend of design genius, shrewd marketing, and evolving consumer desires. Its distinctive "ugly-cute" aesthetic—mischievous yet endearing—has resonated across demographics, particularly with adults drawn to playful, nostalgic items. This unique visual identity ensures instant recognition and sparks a curiosity that transcends age.

A major accelerant for Labubu's viral explosion was the undeniable power of influencer and celebrity marketing. The toy's global visibility and demand skyrocketed after BlackPink's Lisa posted an Instagram photo with her Labubu doll in April 2024. This single endorsement transformed Labubu into a coveted fashion accessory, seen dangling from high-end handbags and sported by other A-listers like Rihanna, Dua Lipa, and Kim Kardashian. It wasn't just a toy anymore; it was a symbol of taste and cultural affiliation.

Beyond celebrity glam, Pop Mart's strategic embrace of scarcity and surprise has been instrumental. The "blind box" format, where you buy a sealed box without knowing which specific version you'll get, creates a "lottery-like" thrill and an enticing element of surprise. This, coupled with limited editions and ultra-rare "secret" figures, engineers a sense of urgency and exclusivity, driving speculative buying and repeat purchases. It's a gamified buying experience that pulls consumers "off of infinite scroll and into line for the latest drops".

The global fanbase and community engagement have further amplified Labubu's appeal. Social media platforms buzz with collectors sharing their passion, showcasing rare editions, and fostering a strong sense of identity and belonging. Labubu's versatility also allows for personal expression, making it an extension of individual taste and even home decor.

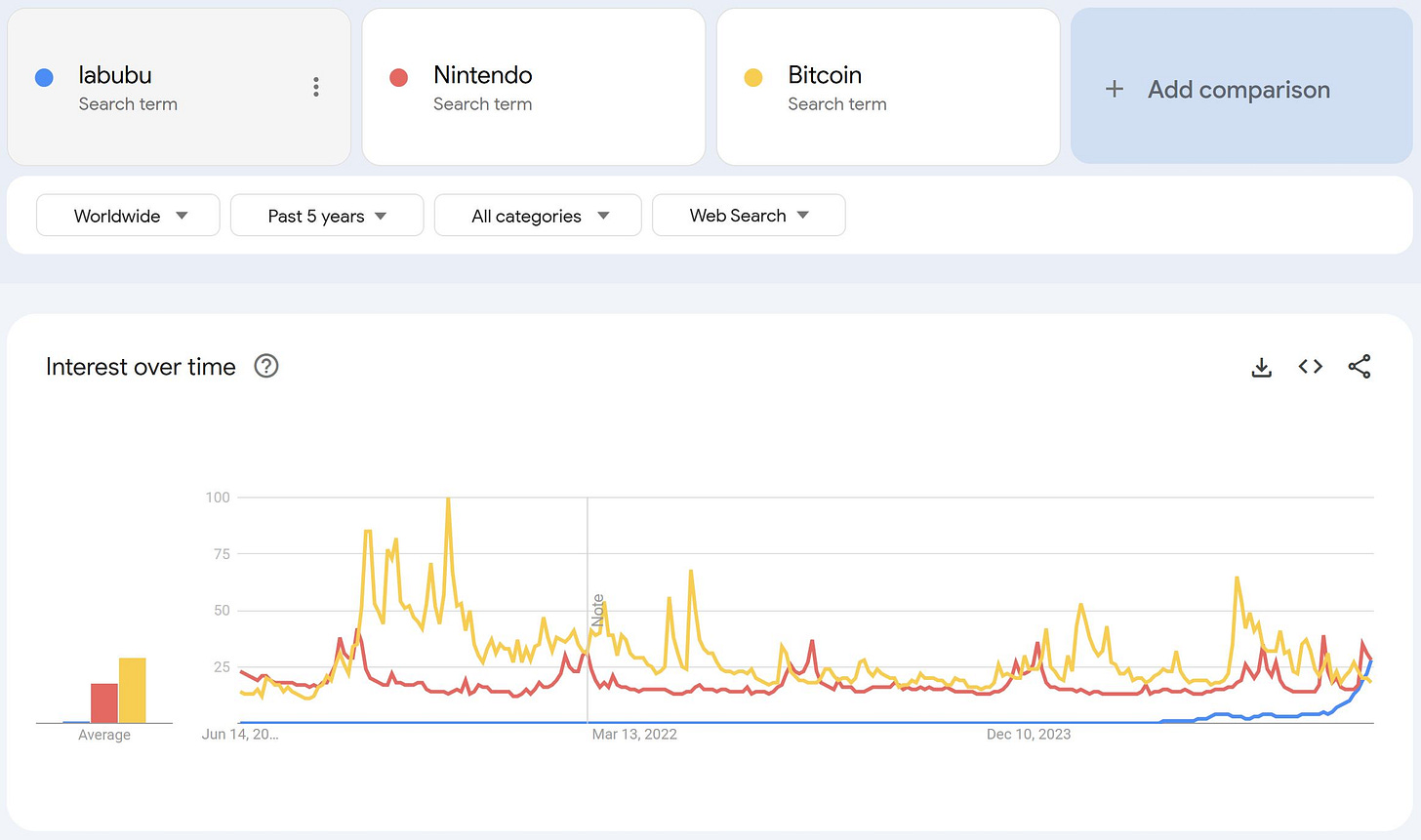

According to the latest Google Trends data, Labubu’s popularity has recently surpassed Bitcoin and is on track to surpass Nintendo over the next couple of days.

Labubu was created by Hong Kong artist Kasing Lung as part of his "The Monsters" story series, drawing inspiration from Nordic folklore and mythology. The character debuted in a picture book trilogy in 2015 and is part of a larger universe with companions like Zimomo, Tycoco, Spooky, and Pato, each adding narrative depth. Labubu’s narrative is not extensively developed or widely known as other popular IPs in China such as Hello Kitty (which surprisngly is not a cat, but a British girl in London), LinaBell (a fox who loves mysteries in the Duffy the Disney Bear universe), Detective Conan (a teenage detective turned child), My Little Ponies (adventures in Dream Valley), Paw Patrol (rescue dogs led by a young boy ), or Ultraman (an alien defender).

However, this perceived lack of a prescriptive narrative for Labubu paradoxically contributes to its mass appeal. For modern, collectible IPs, a less rigidly defined backstory, combined with a strong visual identity and strategic marketing, can enhance global resonance. This approach allows consumers to "project their feelings" and "create their own story," fostering a deeper personal connection and customizability. It echoes Sanrio's deliberate choice for Hello Kitty, which has no visible mouth so people can "project their feelings onto the character". This signals a departure from traditional IP models where extensive lore is paramount, suggesting a new, more adaptable pathway for character brand building in the digital age.

Beyond its commercial triumph, Labubu's global ascent carries broader implications for China's economic narrative. Created by a Hong Kong-born artist and scaled globally by a Chinese company, Labubu's success is being explicitly lauded by Chinese state media. Publications like Qiushi, the Communist Party's top theoretical journal, have praised Pop Mart's creativity and Labubu's popularity as tangible evidence of China's transformation from a "producer of low-value goods" to a "hub of innovation" and a "global incubator where seeds of creativity are sprouting everywhere". This perspective suggests that successful, globally recognized intellectual properties like Labubu are viewed as strategic assets that contribute to China's soft power and influence on the global stage, signaling a deliberate and significant shift in national economic policy towards high-value, creative industries.

The Veblen Paradox: When Desire Fuels Disorder

Labubu's market dynamics perfectly illustrate the characteristics of a Veblen good: demand for the product increases as its price and perceived exclusivity rise. Pop Mart has masterfully cultivated this status through its deliberate strategy of limited runs, randomized drops, and the inclusion of "secret" editions within its blind box series. This engineered scarcity transforms the act of acquisition into a competitive pursuit, elevating the toy's desirability to a fever pitch.

This carefully managed scarcity translates directly into significantly inflated prices on the secondary market. Resale prices for Labubu collectibles frequently soar, ranging from $90 to $400, often double or triple the retail price. Most recently, a rare blue Labubu was auctioned for ¥1.08m (approx USD$150k).

The intense demand, however, has come with real-world consequences, with significant "safety concerns" at Pop Mart stores, particularly in the UK, leading to temporary pauses in in-store sales. These incidents highlight the tangible public order challenges arising from the scarcity model.

A significant and pervasive issue stemming from this demand is the proliferation of professional "scalpers" and organized "syndicates" who acquire large quantities of the dolls to resell them online at exorbitant markups. This practice deeply frustrates genuine fans and alienates core collectors, who find it increasingly difficult to purchase items at retail prices.

The "blind box" mechanism, while a wildly successful sales tactic, is a sophisticated psychological strategy that gamifies the purchasing experience. By introducing a "lottery-like thrill" and the pursuit of elusive "secret" figures, Pop Mart taps into powerful behavioral patterns that can be highly addictive. This gamification amplifies the Veblen effect by adding an element of chance and reward, driving repeated engagement and consumption. However, this strategy also carries a significant dark side: when combined with extreme scarcity, it creates an environment ripe for exploitation by scalpers and leads to consumer frustration and even public disorder. This demonstrates how a highly effective marketing strategy can inadvertently foster negative social consequences, creating a "demand-side" moral hazard where the company benefits from the hype while its loyal customer base endures frustration and unsafe purchasing conditions.

The substantial and rapidly escalating secondary market prices for Labubu, coupled with the emergence of organized scalper syndicates, clearly indicate that Labubu has transcended its identity as a mere toy or collectible. It has evolved into a speculative asset class, attracting professional arbitrageurs who view it primarily as a vehicle for profit rather than personal enjoyment. This transformation creates a parallel economy that both fuels the initial hype, by creating artificial demand, and simultaneously exploits genuine consumer desire. This poses a systemic challenge to Pop Mart's brand integrity and its ability to control its market. This phenomenon highlights a broader trend of "hypebeast" culture extending beyond traditional categories like sneakers and fashion into new consumer product sectors.

The Shareholder's Shadow: Pop Mart's Growth Imperative

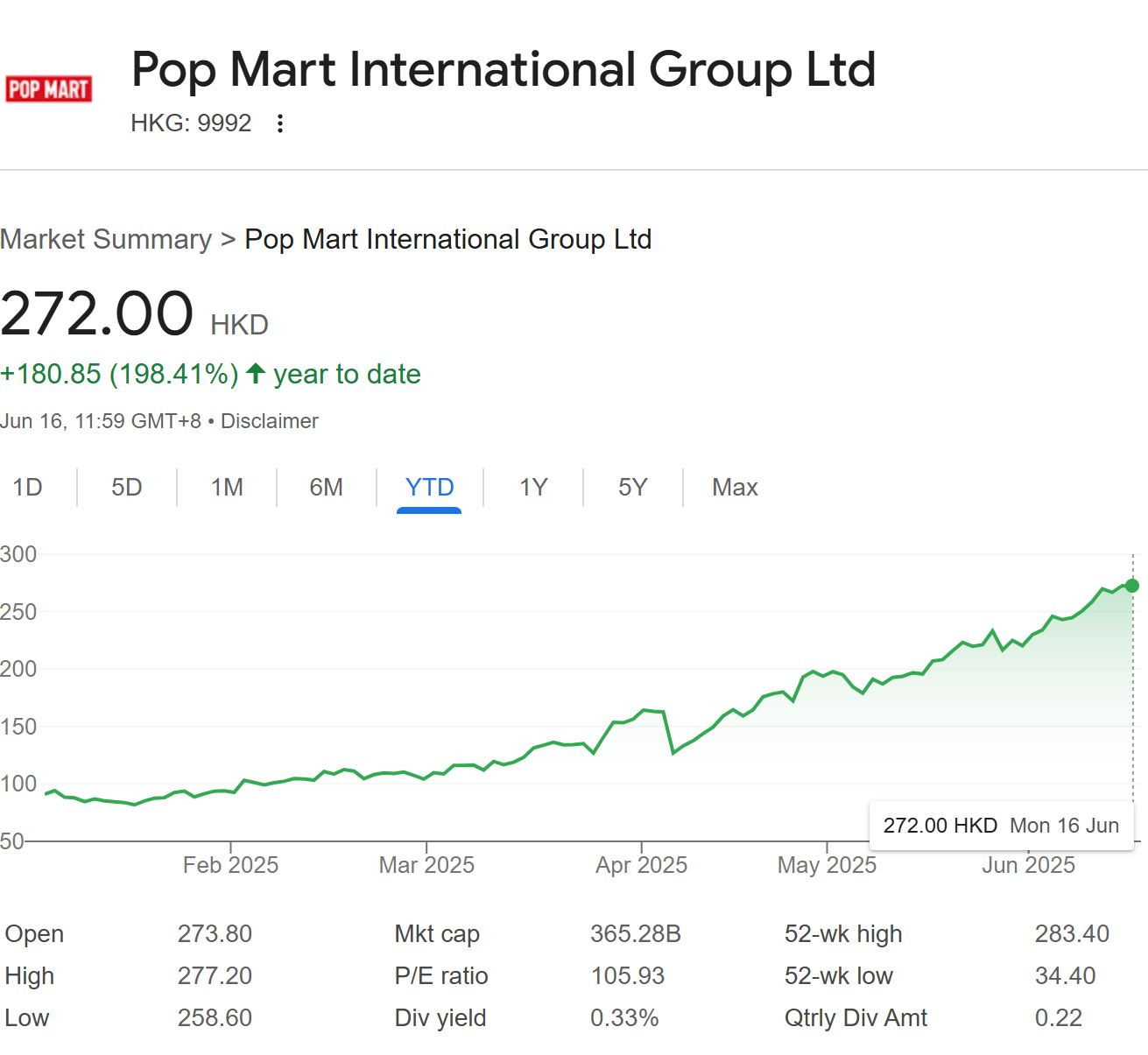

As a publicly listed company on the Hong Kong Stock Exchange, Pop Mart operates under immense pressure to deliver consistent and aggressive financial growth to its shareholders, with the share price increasing 200% year to date and the stock now trading at 50x normalised forward earnings, this is alot of Labubu’s to sell into prepetuity to justify the current valuation even factoring further potential earnings upgrades to come.

Pop Mart's growth strategy is a complex balancing act between maximizing a proven domestic formula and navigating the unique challenges and opportunities of a globalized market. The aggressive overseas expansion is not merely about capitalizing on Labubu's viral hype; it is a strategic imperative to diversify revenue streams. This diversification helps to mitigate risks associated with economic fluctuations in a single market or potential regulatory shifts, particularly in China where government oversight can be significant. The rapid international growth introduces new layers of complexity in managing brand perception, supply chain logistics, and local market demands, as evidenced by the temporary sales pauses in the UK due to safety concerns. The company's dual imperative involves maintaining its dominant position in China while successfully integrating and expanding into diverse international markets.

The Impossible Trinity: Pop Mart's Strategic Conundrum

Pop Mart finds itself at the nexus of a challenging strategic "impossible trinity," a set of three inherently conflicting objectives that cannot be simultaneously achieved to their fullest extent. These three goals are:

Maintaining Exclusivity & Veblen Status: Preserving Labubu's high perceived value and desirability, which is intrinsically linked to its scarcity and high secondary market prices.

Achieving Aggressive Sales Growth & Shareholder Returns: Fulfilling the corporate imperative of a publicly traded company to scale revenue and profit across its intellectual properties, particularly Labubu, to meet elevated market expectations.

Ensuring Social Harmony & Favorable Regulatory Environment: Navigating public sentiment by preventing chaotic scenes and managing the adverse effects of scalping, while maintaining positive relations and avoiding intervention from the Chinese state.

The inherent conflicts among these objectives create a complex web of trade-offs for Pop Mart.

Conflict 1: Scarcity vs. Mass Production. The very essence of Labubu's Veblen good status and its ability to command high secondary market values relies on controlled, limited supply and engineered scarcity. This deliberate restriction fuels hype and desirability. However, a publicly traded entity like Pop Mart is under immense pressure to deliver consistent, aggressive sales growth and expand its market footprint to satisfy shareholder demands. Flooding the market with Labubu products to meet these ambitious sales targets would inevitably dilute the character's exclusivity, cause a significant collapse in its secondary market pricing, and ultimately erode its status as a Veblen good. This direct inverse relationship between supply volume and perceived value presents a fundamental strategic tension.

Conflict 2: Scarcity Leading to Social Issues. While the strategy of engineered scarcity effectively drives hype and demand, it directly contributes to significant consumer frustration, the proliferation of scalping activities, and chaotic scenes at retail locations. This alienates core fans who are unable to purchase products at retail prices and creates negative publicity for the brand. The company's successful marketing strategy, which relies on creating artificial scarcity and leveraging the "blind box" thrill, inadvertently creates a "demand-side" moral hazard. The very conditions that fuel Labubu's Veblen appeal also incentivize scalpers and lead to chaotic consumer behavior.

Conflict 3: Social Stability as a "Hard Red Line" for the Chinese State. The Chinese state media has been overtly supportive of Pop Mart's innovation and global success to date, viewing it as an example of China's economic transformation and soft power projection. However, this support comes with an implicit social contract. Maintaining social stability is a paramount objective for the Chinese Government. Any significant social problems, such as widespread public disorder from chaotic queues or pervasive consumer dissatisfaction stemming from scalping and perceived unfairness, could be deemed a "red line" by the state. This creates a non-negotiable constraint for Pop Mart. Should the social costs of its scarcity model become too high, the state could swiftly intervene, forcing a fundamental shift in business practices that might prioritize social order over commercial strategy or brand equity. Complicating matters, China's governance landscape is profoundly shaped by the cyclical regulatory pattern encapsulated in the phrase "一管就死,一放就乱" (tight control leads to stagnation, loose control leads to chaos).

Navigating the Trilemma: We Watch From the Sidelines

Navigating this complex "impossible trinity" demands that Pop Mart adopt a multi-pronged strategic approach, balancing its commercial ambitions with its brand integrity and social responsibilities. For now, we will watch patiently as the story unfolds.