The Global AI Data Center Bargain You’ve Never Heard Of

A deep dive into Cummins best kept secret, and why it’s poised for a re-rating at 6x PE

Author’s note: as we highlighted in our last portfolio update (link), we rotated out of CYD into H22 and another undisclosed AI data center play, with H22 largely flat vs. CYD down 15% since the switch, we have successfully captured upside volatility while limiting downside risks.

This note describes our previously undisclosed position in further detail, following recent correction, it is now at a similar valuation set-up to CYD at the beginning of February before the rally.

For industry background, please refer to our CYD initiation note (link).

Description

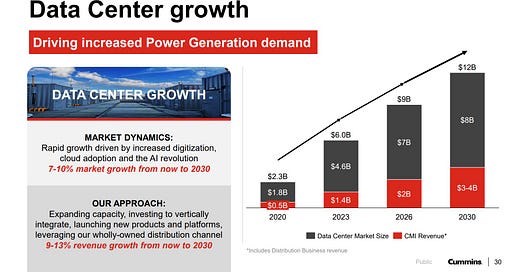

What would you be willing to pay for the number one global AI data center power generation market leader in an oligopolistic industry that earns 25% EBIT margins, just completed a new plant upgrade while generating 60% ROIC, and is expected to grow 20%+ p.a. This company consistently pays out all its earnings as dividends. 20x PE? 30x PE, 40x PE? Well now you can have it all at less than 7x!

Financials

But what's the catch?

This company is wrapped up in a Chinese state owned industrial conglomerate: Chongqing Machinery & Electric Co (2722 HK) and currently undergoing significant market reform.

Chongqing Cummins Engine Company Cummins Overview

Cummins (CMI US) the global diesel engine market leader established three major joint ventures in China, with Chongqing Cummins Engine Company (CQ Cummins) manufacturing the largest diesel engines serving the industrial and power markets.

CQ Cummins was established in 1995 as a joint venture with 2722, which grants the company non-exclusive and non-transferable patents that leverage Cummins Inc’s expertise to manufacture and sell large diesel engines in China. The agreement, originally due to expiration in 2025, was extended to 2040 in May 2022, and a new plant was put in place with an annual production capacity of 23,000 engines (vs. 15,000 in the previous factory) (1). Most importantly, as part of the renewal, CQ Cummins gained license to produce the QSK60 engine range (2), one of the most common engines used in Chinese data centres and across the Asia-Pacific region.

While Cummins Chinese JVs collectively earn 10% net profit margins through the cycle, CQ Cummins is the most profitable margin-wise, generating 15-25% EBIT margins over the past decade. This is due to several factors including:

1) Large diesel engines were historically used in large-scale industrial and mining operations, which has been less susceptible to electrification trends.

2) There continues to be a significant technological gap between Chinese domestic engines and foreign high horsepower engines, with Cummins commanding a ~30% price premium versus domestic data center peers (Weichai and Yuchai) despite being manufactured in China due to superior reliability driving lower total cost of ownership.

3) Oligopolistic market structure, with Cummins, Caterpillar, and Rolls Royce commanding ~70% of the global market, in China Cummins has around 40% data center market share historically.

4) Diesel engines occupy a unique position where they represent a tiny proportion of project capex/opex, but having high efficiency and operational uptime is critical for client success, therefore clients are less price sensitive.

Although highly profitable, diesel engines were supposed to be a low growth cash cow industry, until generative AI changed everything. With significant capital investment to support the build-out of new data centers, diesel engines have become a key requirement in ensuring safe and secure backup power generation, in China, regulations mandate that all data centers have diesel engines as backup generation.

As a result of massive incremental demand, there is currently a significant global shortage in backup diesel generators, with order books extending well into 2026, coupled with double-digit price increases. On its 2024 full year results call, Caterpillar highlighted "it’s all about how quickly you can increase capacity for your reciprocating engines". Cummins recently announced a $200 million investment across its U.S., England, and India manufacturing sites to meet rising power generation demand on its full year 2024 results call.

In China, the AI capex cycle has lagged the US by approximately one year, with Bytedance first signaling a doubling of data center capacity investment at the end of 2024 and Alibaba highlighting a significant uptick in capex for the next 3 years at its recent full year results. Tencent, another key industry player, should report its 2025 capex plan on its results call later this month. As a result, demand for diesel backup generators in China is expected to increase from ~3,000 units in 2024 to at least 4,500 units in 2025.

For CQ Cummins, earnings have already begun inflecting. On the Q2 2024 Cummins results call, the company highlighted: “Sales of Power Generation equipment in China increased 36% in the second quarter, primarily driven by accelerating demand in data centers. This helped drive aggressive financial performance at our Cummins Chongqing joint venture within our Power Systems business.”

While 2722 has not reported 2024 results, one can deduce the net income generated from Cummins' own 2024 10K report, which showed CQ Cummins earnings up 67% yoy in 2024 vs. 13% growth in 2023, this compares to Cummins other Chinese joint ventures, which show broadly stable earnings year on year with overall revenues down due to weak China truck market.

Chongqing Cummins Outlook

Cummins highlighted at Barclay’s Industrial conference in Feb 2025: “ China, of course, is a massive market, big for us. In the power systems relevant space, power generation in data centers and the mining space has remained quite intense for the last several years. And we see -- we expect that to continue this year. “

Given CQ Cummin's significant capacity expansion completed in 2022, I forecast 30% earnings growth in 2025 and 25% in 2026, with upside risks in these numbers, supported by industry channel checks and commentary from peers. MTU Yuchai, a similar joint venture owned by China Yuchai (NYSE: CYD) and Rolls-Royce, highlighted on its 2024 full year earnings call:” We are refusing further orders because we cannot take any due to the capacity constraint on the component supply. But I would say then in the 2025 it's very significant growth compared to last year, it's at least 30%”

Historically, the CQ Cummins has paid ~100% of its earnings to CMI and 2722, however, 2722 has only chosen to distribute ~35% of its profits to shareholders, instead opting to invest in the core business, which consists of manufacturing general industrial machinery.

Like many SOEs, these businesses are not highly profitable and exist to support the local economy, generating employment and local tax revenue, with the core business historically generating around RMB100m in operating income yearly, enough to cover annual interest expense.

What's changed?

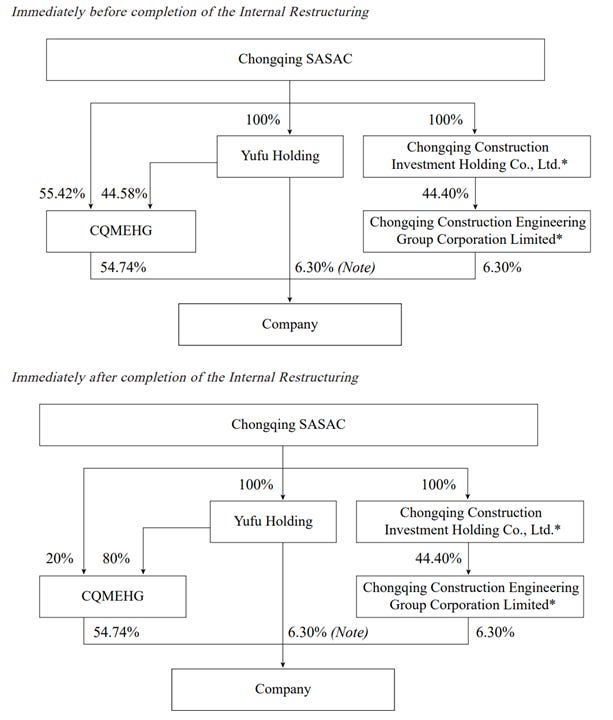

In China, state owned enterprises are controlled by the local State-owned Assets Supervision and Administration Commission (SASAC), and Chongqing SASAC is the ultimate beneficial owner of 2722 through control of its parent Chongqing Machinery & Electronics Holding (Group) Co., Ltd. (CQMEHG), a ¥46bn annual revenue industrial conglomerate.

However, like 2722, the CQMEHG has historically suffered from poor capital allocation and on February 10th, the Chongqing SASAC boss Zeng Jinghua visited CQMEHG headquarters to oversee its reform and development, emphasizing the need to accelerate restructuring by March 31st, 2025 (3).

On February 26th, 2025, 2722 announced that Yufu Holdings is taking control of 2722’s parent company, CQMEHG, and by extension 2722 from the SASAC (4). Yufu Holdings has expertise in active management and investment execution, including corporate restructuring, asset optimization, and capital allocation.

While impossible to pre-empt what changes Yufu will bring for 2722, this represents free optionality upside. One key change would be to see if the dividend payout ratio is lifted for 2722. In aggregate, dividends from Chongqing SOEs have increased substantially over the past few years, and 2722 has lagged the change.

Valuation

Math: If you believe the core CQ Cummins business is worth at least 7x 2025 EBITDA (base-case valuation), the stock is a Buy. Conversely, the stock is not worth holding if CQ Cummin’s is only worth 5x EBITDA/7x PE. However, given the 6% dividend yield at ~HKD$1.05, I fail to see meaningful fundamental share price downside should the company resume dividend payout at 35%.

Cummins (CMI) and China Yuchai (CYD), two direct comparables to 2722, currently trade at a forward PE of over 15x, with CYD only achieving such a record valuation over the past few months as investors increasingly became aware of its long-term earnings tailwind from its data center exposure. Locally, Weichai (000880) trades at closer to 40x PE and Cummins India (500480) trades on a similar valuation level.

Short-Term Trading Dynamics

In contrast to CYD, where we were one of the first investors globally to spot its potential in the data center market, 2722 has already experienced significant volatility, as short-term traders jumped on and off the Chinese AI bandwagon over the past few days, with little regard for fundamental value.

As earnings and dividends come through, we expect the stock to re-rate. It is not difficult to envision 2722 becoming a multi-bagger over the next few years through market reform, increasing the payout ratio from the current 35% to 50% alone, would see the share price floor be established at around HKD$1.5 level given the 6% dividend yield on offer.

Risks

The most significant uncertainty lies with what Yufu will bring for 2722, overall, we believe that the free optionality upside combined with the current valuation support is enough to warrant an investment in 2722. However, position sizing is essential given the share price volatility and current ownership base.

Despite decoupling risks between China and the west, we are not concerned about Cummins' long-term commitment to the Chinese market as China is one of Cummins' most essential profit drivers (~20% group profits) as well as a key manufacturing and innovation hub (alongside the Americas and India hub). On the 2024 Analyst Day, management highlighted: “We are moving capacity into India and China from some of our higher-cost locations because our customer base is residing in those countries.”

Source:

(1) https://ccec-engine.com/chongqing-cummins-new-base-officially-put-into-operation/

(2) https://mp.weixin.qq.com/s/8tLXGTXv30AL_gKX6p7ALQ

(3) https://www1.hkexnews.hk/listedco/listconews/sehk/2025/0226/2025022600733.pdf

(4) https://www.cls.cn/detail/1939658